Although the market’s growth was halted for a while by the Covid-19 pandemic, the sector of premium and luxury cosmetic brands in Poland had already been growing dynamically again from the beginning of 2021. Do you want to conquer the Polish market with your premium cosmetics brand? Find out who your Polish customers are and how to reach them.

Table of contents:

- The premium and luxury cosmetics sector in Poland

- Who are the customers of premium cosmetics in Poland?

- How to reach Polish customers with expensive cosmetics?

- Innovation

- Consumer experience

- Environmental impact

- Brand ambassadors

The premium and luxury cosmetics sector in Poland

According to earlier speculations, the estimated average annual value growth of the luxury and premium cosmetics and perfumes market in Poland until 2024 was expected to be 2.7%. Today, we already know that the negative economic impact caused by Covid-19 caused the segment to record a decline in sales by as much as 16.6%, reaching 833 million in 2020. The premium brand sector was affected by the pandemic more than the mass cosmetics segment. Fortunately – for manufacturers – 2021 was a time of renewed dynamic growth. Although we do not yet have market value figures, at the beginning of 2021 sales of super premium brands were predicted to grow faster than the overall cosmetics market (according to data from Euromonitor’s digital report) – annually by an average of 7% over the next few years.

The majority of cosmetics that Polish customers can get on shop shelves and online are imported products. Cosmetic imports have been on a long-term upward trend for many years. Although the market is dominated by brands such as L’Oreal (12% share in the retail market) or the Polish brand Dr Irena Eris (1.9% share), there is a high fragmentation of brands, which allows niche products to establish themselves (this is especially related to current fashions, e.g. for premium cosmetics from Asia). Most cosmetics come to Poland from Germany, France and Belgium. In 2020 their share of the cosmetics market in Poland was 46% – although this is a decreasing trend. For it is worth bearing in mind that Poland itself is beginning to become a big player on the export market for its own cosmetics. The country is currently ranked 14th among the biggest exporters of cosmetics in the world. So if you want to compete on this market, you need to be aware of the existence of strong premium Polish brands.

Who is the customer for premium cosmetics in Poland?

According to official data, the number of very rich people (with a monthly gross income of over 50 thousand PLN) living in Poland is over 66 thousand. Society is becoming more and more affluent, and premium cosmetic brands are seeing a clear influx of new consumers – especially women. The most numerous group of customers are people between 31 and 45 years old, although a large group are also those over 45 years old. They are also the most loyal consumers and often stay with a single brand for several or even more than a dozen years.

The last decade of the Polish premium cosmetics market shows the growing importance of a new group of consumers – millenials and, interestingly, representatives of generation Z (people born after 1995). It is the millenials who will transform the market – today they are responsible for the purchase of 32% of all luxury goods (but it is estimated that by 2025 this value will rise to 50%). Although Generation Z today accounts for 4% of consumers, the number of young people interested in expensive cosmetic brands is much higher than ever before. In the 2019 report The Luxury Goods Market in Poland, Dr Irena Eris’ head of brand communications Joanna Łodygowska highlighted that they see a growing influx of young and affluent female consumers from Poland.

How to reach them?

According to a Santander Bank report from 2021, currently as much as 78% of cosmetics in Poland are sold in stationary shops: general shops, drugstores and pharmacies. Online sales of cosmetics in Poland, in turn, account for 11% of retail turnover (the remaining 10% is direct sales). However, the pandemic has translated into an increase in the share of e-commerce. Research predicts that by 2025, online purchases of all luxury goods will already account for almost 20% of the entire market.

This is important information for owners of premium cosmetic brands – especially given the growing importance of product sales among young consumers, who shop primarily online. However, we are still talking about sales experience. But how do you go about communicating with your customers? Here are some tips from a Polish marketing agency on how to effectively reach consumers of premium and luxury cosmetic brands in Poland:

1. Innovation

Merely advertising cosmetics does not work in the premium sector – unless you do not plan to compete for market leadership. The bar is set very high. Here, it is worth noting the successful activities of the domestic brand Dr Irena Eris (currently the brand is ranked 9th in the cosmetics sales sector on the Polish market and is the only Polish selective brand admitted to the French association of the most luxurious cosmetic brands).

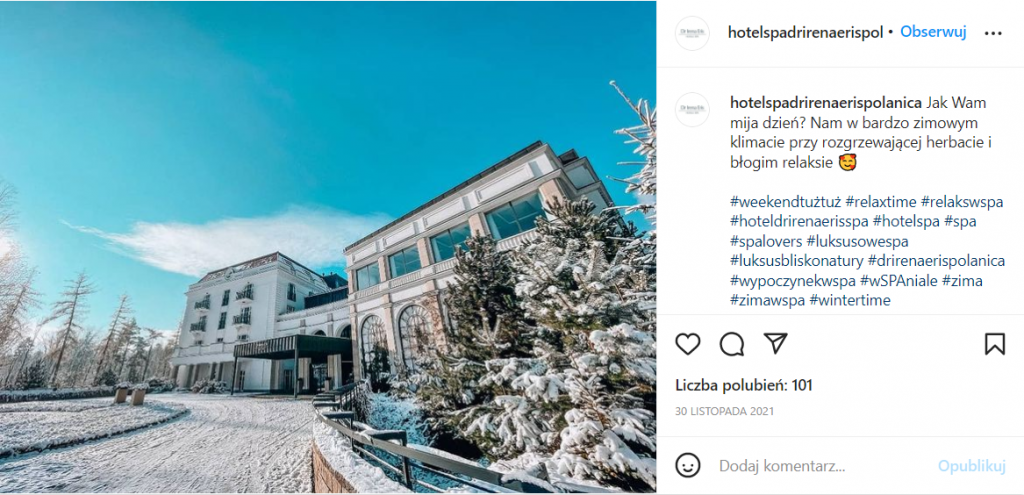

It builds its competitive advantage through innovation. It is one of the few companies not only in Poland, but also in the whole world, which has its own scientific and research centre. Polish consumers are taking a closer look at cosmetic compositions and reaching for products containing tested active ingredients. However, the Dr Irena Eris brand is not only well researched cosmetics, but also cosmetic institutes, SPAs and hotels, as well as a stationary concept store.

2. Customer experience

It has been said that premium brand marketing should not rely on sales campaigns at all. Polish customers in this segment are not very eager to be tempted by all kinds of promotions or price reductions – Some may even be deterred. Much more important here is branding: what the brand values are and what the consumer should think about it. Experience marketing should therefore come first. That means focusing on the consumer’s shopping experience.

A great area for building experiences and personalising services is of course the Internet. Today, many luxury cosmetic brands (such as MAC) provide customers with virtual mirrors that allow them to match foundation or eye shadow. In retail, too, care must be taken to ensure that customers experience prestige at every stage of the shopping experience – from the packaging, to the appearance of the shop, to the service. A good example of this can be found in Estēe Lauder’s Polish stationary stores, which build the consumer experience from the very entrance.

3. Environmental impact

For Polish customers of premium cosmetic brands, caring for the environment is an increasingly important factor that determines the purchase of products. This is related not only to the increasing consumer awareness, but also to the growing importance of customers from younger age groups who are very conscious about ecology. Care for the environment (e.g. ecological packaging), safe ingredients, vegan or non-animal tested cosmetics and sustainable development are the strongest trends on the Polish cosmetics market today – also among premium brands. It is worth basing your PR communication on them.

An interesting example of such activities is the Tarte brand owned by the Japanese manufacturer Kosé. Tarte is currently a pioneer in using high quality natural products, awarded for their formulas and ecological packaging. The brand entered the Polish market last year (for retail sale in Sephora drugstores) and was promoted in social media, women’s press (Wysokie Obcasy, Elle, Glamour, Vogue Polska) and in cooperation with Polish influencers – as one of the hottest brands in the beauty world, backed by ingredients of natural origin, Beauty Without Bunnies certificate from PETA, social responsibility programmes and vegan formulas of cosmetics, including skin care products.

Source: https://www.glamour.pl/artykul/ulubiona-marka-makijazystow-gwiazd-oraz-internautek-w-koncu-dostepna-w-polsce-kultowe-kosmetyki-kupicie-w-perfumeriach-sephora-200817092150

4. Ambassadors

A strong branding of a high-end cosmetic brand should start by working with strong ambassadors who are credible to the target group. It is the female (or male) ambassadors who make a brand visible – especially in Polish social media. Here, depending on the target group, you can even have several ambassadors in different age groups and reach their audience through several different communication channels – not only online, but also on television, outdoor advertising and in the women’s press. Omni-channel marketing strategies, which combine many different marketing platforms, therefore work best here.

An example of such activities can be the Clochee brand. The brand invited Polish celebrities Małgorzata Rozenek-Majdan and Joanna Krupa to cooperate in the promotion of its new line of premium cosmetics for children, Clochee – Baby & Kids. This was not a random choice – both women have small children and are both in their thirties, and their communication reaches the exact Clochee target group.

These are, of course, only the basic data you need to know when launching a new premium or luxury cosmetics brand on the Polish market. If you are looking for an experienced Polish advertising agency, which for years has been supporting foreign brands in winning the hearts of wealthy Polish customers, do not hesitate to contact us. Our experts will listen to your needs and goals.